Homeowners Insurance in and around Terre Haute

Terre Haute, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Your house isn't a home unless you're insured by State Farm. This great, secure homeowners insurance will help you protect what you value most.

Terre Haute, make sure your house has a strong foundation with coverage from State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

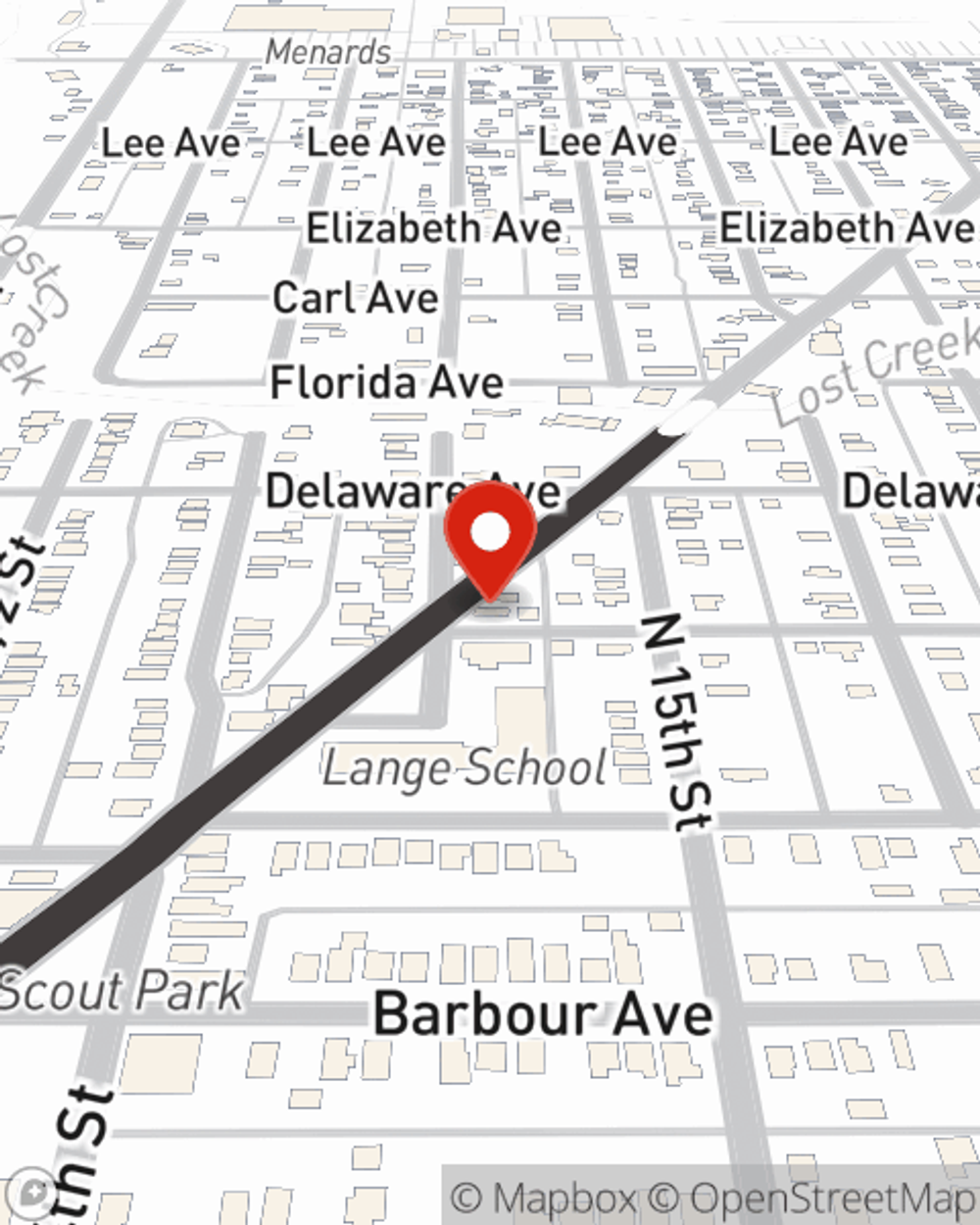

Agent Kelsi Lubovich, At Your Service

State Farm's homeowners insurance covers your home and your possessions. Agent Kelsi Lubovich is here to help build a policy with your specific needs in mind.

Don't let your homeowners insurance go over your head, especially when the unexpected happens. State Farm can bear the load of helping you put together the right home policy. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Kelsi Lubovich today for more information!

Have More Questions About Homeowners Insurance?

Call Kelsi at (812) 466-1740 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Kelsi Lubovich

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.