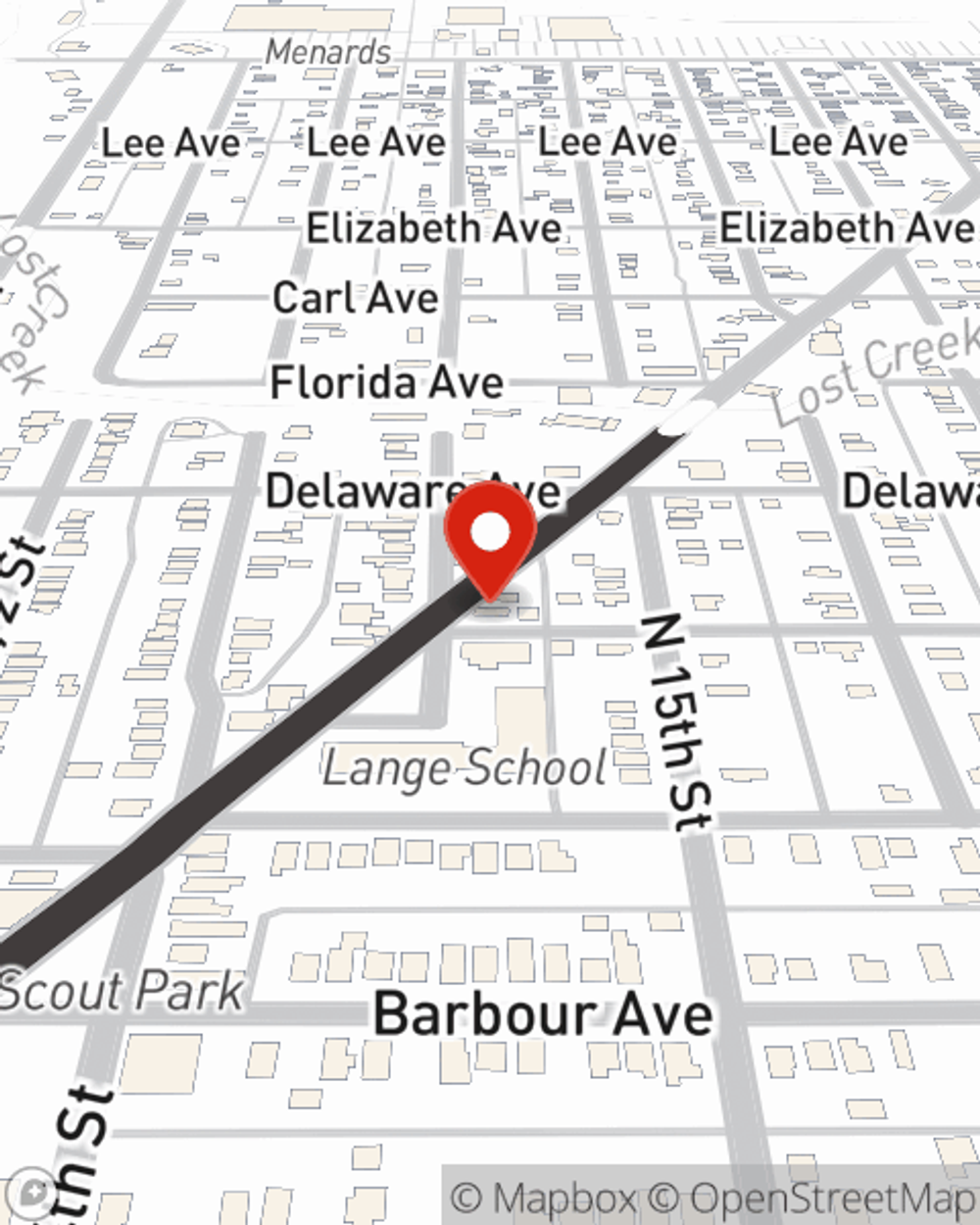

Business Insurance in and around Terre Haute

Calling all small business owners of Terre Haute!

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Value!

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide terrific insurance for your business. Your policy can include options such as business continuity plans, extra liability coverage, and errors and omissions liability.

Calling all small business owners of Terre Haute!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Whether you own a clock shop, a beauty salon or an ice cream shop, State Farm is here to help. Aside from exceptional service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by reaching out to agent Kelsi Lubovich's team to discuss your options.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Kelsi Lubovich

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.